FreshBooks is a leading cloud-based accounting and invoicing software designed specifically for small businesses and freelancers. Launched in 2003, FreshBooks has become a trusted name in the industry, providing an intuitive and user-friendly platform for managing finances, tracking time, and streamlining invoicing and expense management.

Table of Contents

The Importance of Cloud-Based Accounting

In the modern business landscape, cloud-based accounting solutions have become increasingly important. FreshBooks allows users to access their financial data from anywhere, at any time, ensuring that they can stay on top of their finances and make informed decisions even on the go. By leveraging the power of the cloud, FreshBooks offers enhanced security, automatic backups, and seamless collaboration with team members and clients.

Target Audience for FreshBooks

FreshBooks is primarily targeted at small businesses, freelancers, and independent professionals who require a simple yet powerful accounting tool to manage their finances. This includes a wide range of industries, such as consulting, creative services, trades, and service-based businesses. The platform’s user-friendly interface and robust features make it an attractive option for those looking to streamline their accounting processes and focus on their core business activities.

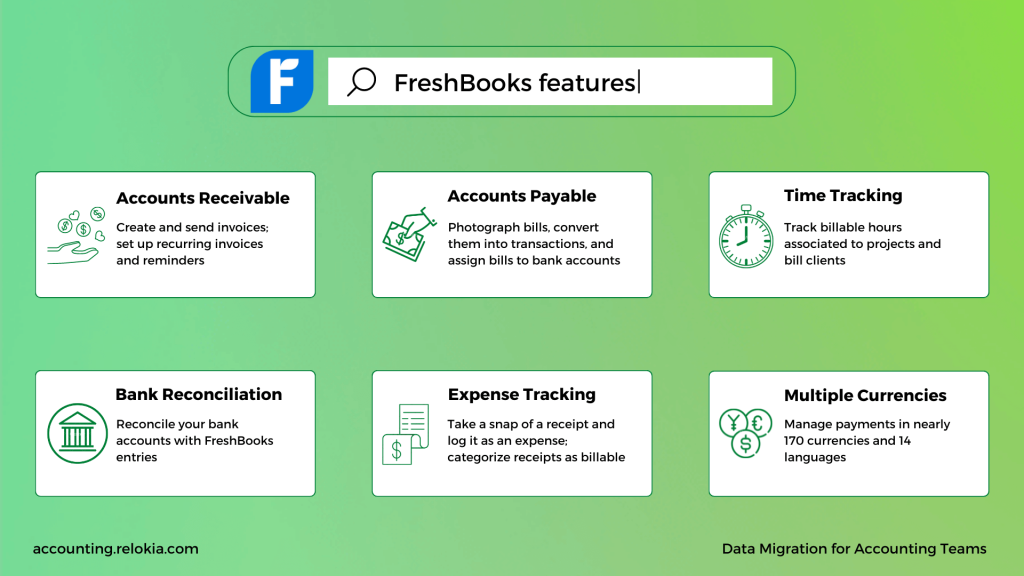

Key Features and Benefits

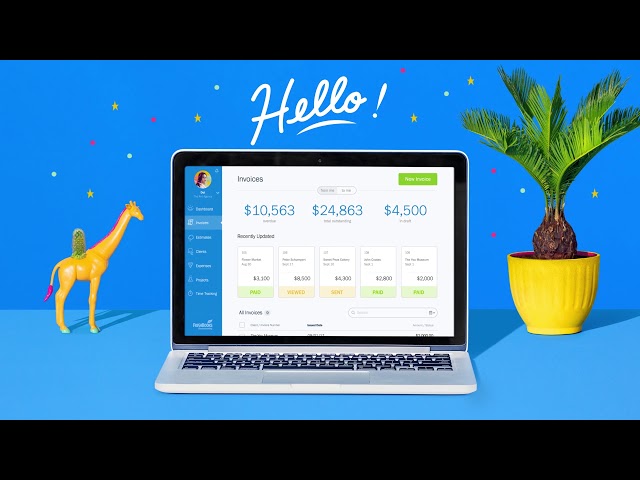

Invoicing: Creating and Sending Professional Invoices

FreshBooks offers a comprehensive invoicing solution, allowing users to create and send professional-looking invoices to their clients. The platform provides a wide range of customizable invoice templates, enabling businesses to showcase their brand identity and personalize their communication with customers. With features such as automatic late payment reminders, recurring invoices, and the ability to accept online payments, FreshBooks simplifies the invoicing process and helps ensure timely payments.

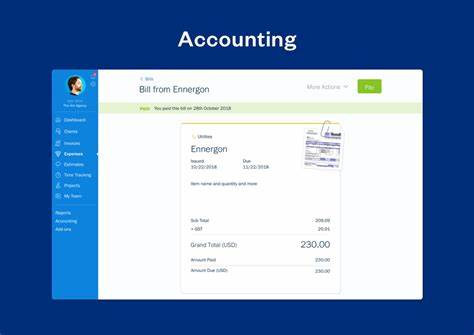

Expense Tracking: Managing Expenses and Receipts

Keeping track of business expenses is a critical aspect of effective financial management. FreshBooks streamlines this process by allowing users to capture and categorize expenses, as well as upload and store digital receipts. This feature helps businesses maintain accurate records, simplify tax preparation, and gain valuable insights into their spending patterns.

Time Tracking: Monitoring Time Spent on Projects

For service-based businesses and professionals, time is a valuable commodity. FreshBooks offers a robust time-tracking feature that enables users to log their billable hours, track team members’ time, and generate detailed reports. This functionality helps businesses accurately invoice clients, ensure fair compensation for their work, and gain a better understanding of their project profitability.

Payment Processing: Accepting Payments from Clients

FreshBooks makes it easy for businesses to accept payments from their clients. The platform integrates with various payment gateways, allowing customers to pay invoices securely using credit cards, debit cards, or digital wallets. This feature helps streamline the payment process, reduce late payments, and improve cash flow for businesses.

Reporting: Generating Financial Reports and Insights

FreshBooks offers a range of customizable reporting options, enabling users to generate detailed financial statements, profit and loss reports, and other business insights. These reports help business owners and managers make informed decisions, track their performance, and provide valuable information to accountants or bookkeepers.

User Experience and Interface

Intuitive Design: Ease of Use for All Users

One of the standout features of FreshBooks is its intuitive and user-friendly design. The platform is built with the needs of small business owners and freelancers in mind, making it accessible and easy to navigate for users of all technical abilities. The clean interface, guided workflows, and helpful tooltips ensure that new users can quickly get up to speed and start managing their finances effectively.

Mobile Accessibility: Managing Finances on the Go

In today’s fast-paced business environment, the ability to manage finances on the go is crucial. FreshBooks offers a robust mobile app, allowing users to access their accounts, create and send invoices, track expenses, and monitor their business performance from their smartphone or tablet. This mobile accessibility ensures that users can stay on top of their finances even when they’re away from their desk.

Customization Options: Tailoring FreshBooks to Your Needs

FreshBooks offers a range of customization options, enabling users to personalize the platform to fit their unique business needs. From customizable invoice templates and custom branding to the ability to add team members and set user permissions, FreshBooks allows businesses to create a tailored accounting solution that reflects their brand and workflow.

Pricing and Plans

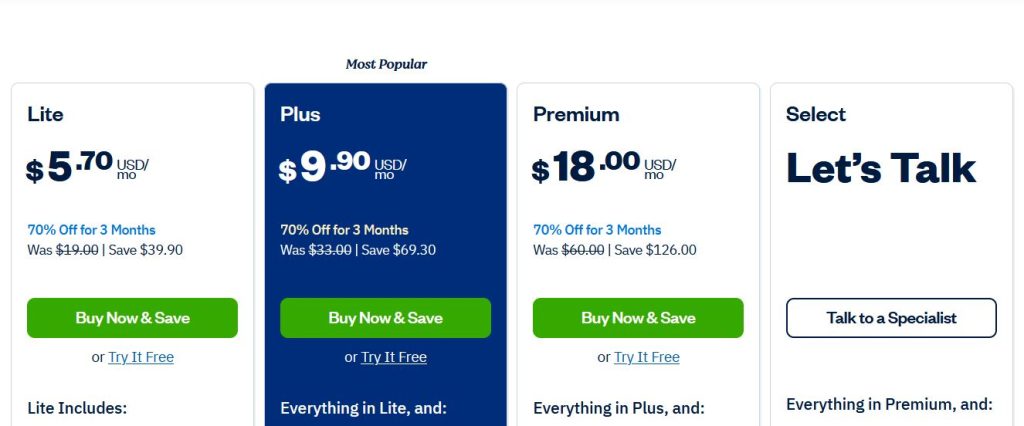

Flexible Pricing: Options to Suit Different Budgets

FreshBooks offers a range of pricing plans to accommodate businesses of various sizes and budgets. The platform’s subscription-based model provides users with the flexibility to scale their plan as their business grows, ensuring that they only pay for the features and functionality they need. Additionally, FreshBooks offers discounts for annual subscriptions, making it a cost-effective solution for long-term users.

Free Trial: Testing FreshBooks Before Committing

FreshBooks provides a free trial period, allowing potential users to test the platform and its features before committing to a paid subscription. This trial period gives businesses the opportunity to explore the software, assess its suitability, and ensure that it meets their accounting and invoicing requirements.

Value for Money: Comparing FreshBooks to Competitors

When compared to other cloud-based accounting solutions, FreshBooks consistently delivers excellent value for money. The platform’s comprehensive feature set, user-friendly interface, and responsive customer support make it a highly competitive option in the market, often outperforming more expensive competitors in terms of overall functionality and cost-effectiveness.

Customer Support and Resources

Responsive Support: Getting Help When You Need It

FreshBooks is known for its exceptional customer support. The platform’s team of knowledgeable and friendly representatives are available to assist users via email, phone, and live chat, ensuring that any questions or issues are addressed in a timely manner. Additionally, FreshBooks provides a comprehensive knowledge base, tutorials, and community forums, empowering users to find answers and learn about the platform’s features on their own.

Extensive Documentation: Learning How to Use FreshBooks

FreshBooks offers a wealth of educational resources to help users get the most out of the platform. The company’s website features a dedicated “Learning Center” that includes detailed guides, step-by-step tutorials, and video walkthroughs, covering a wide range of topics from invoicing and expense management to reporting and integrations. This extensive documentation ensures that users can quickly become proficient in using FreshBooks to manage their finances effectively.

Community Forums: Connecting with Other Users

FreshBooks has a vibrant community of users who actively engage with one another on the platform’s community forums. These forums provide a valuable resource for users to share best practices, ask questions, and receive support from fellow FreshBooks enthusiasts. By tapping into this community, businesses can learn from the experiences of others and stay up-to-date with the latest tips and tricks for using the software.

Case Studies and Testimonials

Real-World Examples: How Businesses Benefit from FreshBooks

FreshBooks showcases a number of case studies and testimonials from its satisfied customers, highlighting the real-world benefits that businesses have experienced by using the platform. These case studies demonstrate how FreshBooks has helped companies streamline their accounting processes, improve cash flow, and focus on their core business activities, ultimately driving their success.

Customer Feedback: Positive Experiences and Success Stories

The FreshBooks website and online reviews feature numerous testimonials from users who have had positive experiences with the platform. These success stories highlight the software’s ease of use, time-saving features, and the overall impact it has had on the growth and profitability of their businesses. By providing these customer insights, FreshBooks helps prospective users understand the potential benefits they can expect from the software.

Comparison to Competitors

FreshBooks vs. QuickBooks

FreshBooks and QuickBooks are both popular cloud-based accounting solutions, but they cater to slightly different target audiences. FreshBooks is generally considered more user-friendly and better suited for small businesses and freelancers, while QuickBooks offers more advanced features and functionality for larger enterprises. When comparing the two, FreshBooks often stands out for its simplified invoicing, expense tracking, and time-tracking capabilities.

FreshBooks vs. Xero

Xero is another leading cloud-based accounting platform that competes with FreshBooks. While both offer robust invoicing, expense management, and reporting features, FreshBooks is often preferred by users for its intuitive interface and specialized small business focus. Additionally, FreshBooks may provide more customization options and a more streamlined user experience for certain use cases.

FreshBooks vs. Zoho Books

Zoho Books is another popular cloud-based accounting software that shares some similarities with FreshBooks. Both platforms offer invoicing, expense tracking, and financial reporting capabilities. However, FreshBooks is often praised for its more straightforward design, user-friendly features, and seamless integration with other business tools, making it a preferred choice for many small businesses and freelancers.

Integrating FreshBooks with Other Tools

Accounting Software Integration: Connecting with Other Accounting Tools

FreshBooks offers integrations with a range of popular accounting software, including QuickBooks, Xero, and Zapier, among others. These integrations allow users to seamlessly sync their financial data, streamlining their accounting workflows and ensuring that their financial information is consistent across multiple platforms.

CRM Integration: Managing Customer Relationships

In addition to its accounting features, FreshBooks also integrates with various customer relationship management (CRM) tools, such as Salesforce and HubSpot. These integrations enable businesses to manage their customer data and financial records in a unified platform, improving their overall client management and communication.

Payment Gateway Integration: Accepting Payments Through Various Methods

FreshBooks supports integration with a wide array of payment gateways, including PayPal, Stripe, Square, and Authorize.net, among others. This flexibility allows businesses to offer their clients a variety of payment options, making it easier for customers to settle their invoices and improving the overall payment experience.

Best Practices for Using FreshBooks

Tips for Efficient Invoicing

To maximize the benefits of FreshBooks’ invoicing features, users should consider best practices such as creating customized invoice templates, automating recurring invoices, and setting up late payment reminders. These strategies can help businesses streamline their invoicing process and improve their cash flow.

Maximizing Expense Tracking

Effective expense tracking is crucial for maintaining accurate financial records and managing business costs. FreshBooks users can leverage features like automatic expense categorization, mobile expense capture, and integrated receipt storage to ensure their expenses are accurately recorded and organized.

Leveraging Time Tracking Features

FreshBooks’ time-tracking capabilities allow businesses to accurately bill their clients, analyze project profitability, and ensure fair compensation for their team members. Users should take advantage of features like automated time tracking, client-facing time logs, and detailed reporting to optimize their time management and billing processes.

Generating Meaningful Financial Reports

FreshBooks provides a range of financial reporting tools, from basic profit and loss statements to more advanced insights. Users should familiarize themselves with the platform’s reporting features and learn how to generate and interpret these reports to make informed business decisions.

The Future of Cloud-Based Accounting and FreshBooks

Emerging Trends in Accounting Software

As the world of accounting and finance continues to evolve, cloud-based solutions like FreshBooks are well-positioned to adapt and capitalize on emerging trends. These include increased automation, artificial intelligence-powered insights, integration with other business tools, and enhanced data security and privacy measures.

Potential Future Developments for FreshBooks

Looking ahead, FreshBooks is expected to continue expanding its feature set and integrations to meet the evolving needs of small businesses and freelancers. This may include further advancements in areas such as automated bookkeeping, advanced reporting and analytics, and expanded payment processing options, all while maintaining the platform’s user-friendly interface and focus on simplifying financial management.

Get Started with FreshBooks

To get started with FreshBooks, users can visit the company’s website at www.freshbooks.com and sign up for a free trial. The sign-up process is straightforward and requires basic information about the user’s business, such as their name, email address, and industry. Once the account is created, users can begin exploring the platform’s features and customizing their settings to fit their specific needs.

Frequently Asked Questions

Q: Is FreshBooks suitable for large businesses?

A: While FreshBooks is primarily designed for small businesses and freelancers, the platform can accommodate the needs of larger enterprises to a certain extent. However, companies with more complex accounting requirements or a need for advanced features may find that other solutions, such as QuickBooks or Xero, are better suited to their needs.

Q: How secure is FreshBooks?

A: FreshBooks takes the security and privacy of its users’ data very seriously. The platform employs industry-standard encryption, secure data storage, and regular backups to ensure the protection of sensitive financial information. Additionally, FreshBooks is compliant with various data protection regulations, such as GDPR and SOC 2.

Q: Can I use FreshBooks for my personal finances?

A: FreshBooks is primarily intended for business use, but some users may choose to leverage the platform’s features for personal financial management as well. However, it’s important to note that the software’s capabilities are geared towards small businesses and may not offer the same level of personal finance-specific features as dedicated personal finance apps or tools.

Q: How does FreshBooks compare to Excel or Google Sheets for accounting?

A: While spreadsheet programs like Excel and Google Sheets can be used for basic accounting tasks, FreshBooks offers a more comprehensive and streamlined solution for small businesses. FreshBooks provides specialized features such as invoicing, expense tracking, time-billing, and financial reporting, which are often more difficult to manage and maintain in a spreadsheet-based system.

Q: Is there a mobile app for FreshBooks?

A: Yes, FreshBooks offers a mobile app for both iOS and Android devices, allowing users to manage their finances on the go. The mobile app provides access to key features, such as invoicing, expense tracking, and time-tracking, enabling users to stay on top of their business finances from anywhere.

Conclusion

FreshBooks has firmly established itself as a leading cloud-based accounting solution for small businesses and freelancers. With its intuitive interface, robust features, and commitment to exceptional customer support, the platform has proven to be a valuable tool for streamlining financial management and driving business success.

By catering to the specific needs of its target audience, FreshBooks has carved out a unique position in the competitive accounting software market. The platform’s versatility, customization options, and seamless integration with other business tools make it a compelling choice for small businesses and professionals looking to take control of their finances and focus on growing their operations.

Whether you’re a seasoned entrepreneur or just starting out, FreshBooks is worth considering as your go-to accounting and invoicing solution. With its powerful features, responsive customer support, and the ability to scale alongside your business, FreshBooks is poised to help you navigate the ever-evolving world of cloud-based accounting and position your company for long-term success.