Efficient and effective accounting is crucial for the success of any business, large or small. Accounting software plays a vital role in streamlining financial processes, improving accuracy, and providing valuable insights for data-driven decision making. By automating tasks like invoicing, expense tracking, and financial reporting, accounting software empowers business owners and managers to focus on core operations and growth strategies.

Table of Contents

Understanding QuickBooks and Zoho Books

QuickBooks and Zoho Books are two of the most popular accounting software solutions on the market today. QuickBooks, developed by Intuit, is a powerful and feature-rich platform trusted by millions of small and medium-sized businesses worldwide. Zoho Books, on the other hand, is a cloud-based accounting software from the Zoho suite of productivity tools, designed to cater to the needs of SMBs and freelancers.

Key Differences and Similarities

While both QuickBooks and Zoho Books aim to simplify accounting and financial management, they offer distinct features, pricing structures, and target audiences. Understanding these key differences and similarities can help businesses make an informed decision in choosing the right accounting software for their unique needs.

QuickBooks: A Closer Look

Core Features and Benefits

QuickBooks is renowned for its comprehensive set of features that cater to the diverse needs of small and medium-sized businesses. From invoicing and expense tracking to payroll and tax preparation, QuickBooks provides a robust suite of tools to streamline financial operations. Its intuitive interface, powerful reporting capabilities, and seamless integration with other business applications make it a popular choice among entrepreneurs and accounting professionals.

Invoicing and Expense Tracking

QuickBooks offers a user-friendly invoicing system, allowing businesses to create professional-looking invoices, set recurring billing, and track outstanding payments. The expense tracking feature simplifies the process of recording and categorizing business expenses, making it easier to monitor cash flow and prepare for tax season.

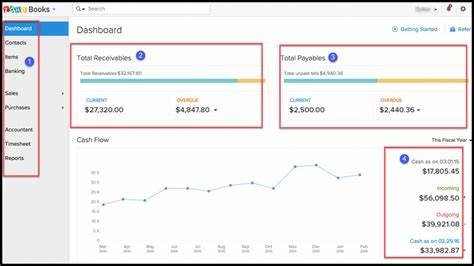

Financial Reporting and Analytics

QuickBooks excels in providing detailed financial reports, including profit and loss statements, balance sheets, and cash flow statements. Its analytics and dashboard capabilities enable users to gain valuable insights into their business performance, identify trends, and make informed financial decisions.

Integration with Other Tools

QuickBooks seamlessly integrates with a wide range of third-party applications, such as e-commerce platforms, payroll services, and customer relationship management (CRM) software. This integration allows businesses to streamline their workflows and maintain a cohesive ecosystem for their financial and operational data.

Zoho Books: A Closer Look

Core Features and Benefits

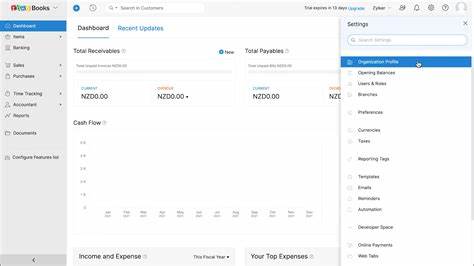

Zoho Books is a cloud-based accounting software that offers a comprehensive suite of features tailored for small and medium-sized businesses. Its user-friendly interface, automated workflows, and real-time financial insights make it an attractive option for entrepreneurs and freelancers looking to manage their finances more efficiently.

Invoicing and Expense Tracking

Zoho Books provides a robust invoicing system, allowing users to create and send professional-looking invoices, set up recurring billing, and track payments. The expense tracking feature simplifies the process of recording and categorizing business expenses, making it easier to monitor cash flow and prepare for tax season.

Financial Reporting and Analytics

Zoho Books offers a range of detailed financial reports, including profit and loss statements, balance sheets, and cash flow statements. Its intuitive dashboard provides users with real-time insights into their financial performance, empowering them to make informed decisions and track their business’s progress.

Integration with Other Tools

Zoho Books seamlessly integrates with other applications within the Zoho suite, such as Zoho CRM, Zoho Inventory, and Zoho Projects. Additionally, it offers a wide range of third-party integrations, enabling businesses to create a cohesive ecosystem for their financial and operational data.

User Experience and Interface

Ease of Use for Non-Accountants

Both QuickBooks and Zoho Books are designed with user-friendliness in mind, making them accessible to non-accountants and small business owners. The intuitive interfaces and step-by-step workflows help users navigate the software with ease, reducing the learning curve and enabling them to focus on running their business.

Mobile Accessibility

QuickBooks and Zoho Books offer mobile applications, allowing users to access their financial data and perform key tasks on-the-go. This mobile accessibility is particularly valuable for entrepreneurs and small business owners who need to manage their finances from anywhere.

Customization Options

While both software solutions offer a range of customization options, QuickBooks is generally seen as more flexible, allowing users to tailor the software to their specific business needs. Zoho Books, on the other hand, provides a more streamlined and standardized user experience, with limited customization options.

Pricing and Plans

Cost Comparison Between QuickBooks and Zoho Books

QuickBooks offers a range of pricing plans, with the basic “Simple Start” plan starting at $25 per month, while the more advanced “Plus” plan is priced at $70 per month. Zoho Books has a more tiered pricing structure, with the “Basic” plan starting at $9 per month and the “Professional” plan at $29 per month.

Value for Money Analysis

When considering the value for money, both QuickBooks and Zoho Books provide robust accounting features and functionality. The choice between the two may depend on the specific needs and budget of the business. QuickBooks may offer more advanced features and integrations, but Zoho Books can be a more cost-effective solution for smaller businesses or those with simpler accounting requirements.

Bundles and Additional Features

Both software platforms offer various bundles and add-on features to cater to the specific needs of their customers. QuickBooks has a range of industry-specific editions, as well as add-ons like payroll and point-of-sale (POS) integration. Zoho Books also offers a suite of complementary tools, such as Zoho Inventory and Zoho Subscriptions, that can be bundled with the core accounting software.

Customer Support and Resources

Responsive Support Teams

QuickBooks and Zoho Books both provide dedicated customer support teams to assist users with any issues or questions they may have. QuickBooks offers various support channels, including phone, email, and live chat, while Zoho Books primarily focuses on online support resources and a responsive ticketing system.

Extensive Documentation and Tutorials

Both software platforms offer comprehensive documentation, including user guides, FAQs, and video tutorials, to help users navigate the software and understand its various features and functionalities. Additionally, QuickBooks and Zoho Books have active online communities where users can share their experiences, ask questions, and find solutions to common challenges.

Community Forums and Resources

The QuickBooks and Zoho Books communities provide valuable resources for users, including forums, user groups, and third-party blogs and tutorials. These community-driven resources can be invaluable for gaining insights, troubleshooting issues, and staying up-to-date with the latest developments in the software.

Comparison of Key Features

Invoicing and Expense Tracking

Both QuickBooks and Zoho Books offer robust invoicing and expense tracking capabilities, allowing users to create professional invoices, track payments, and categorize business expenses. However, QuickBooks may have a slight edge in terms of the depth and customization of its invoicing features.

Tax Preparation

QuickBooks is widely recognized for its comprehensive tax preparation features, including the ability to track and categorize tax-related expenses, generate tax reports, and integrate with tax preparation software. Zoho Books also provides tax-related features, but they may not be as advanced as those offered by QuickBooks.

Financial Reporting

Both software platforms offer a range of financial reports, including profit and loss statements, balance sheets, and cash flow statements. QuickBooks is generally seen as providing more robust and customizable reporting capabilities, while Zoho Books focuses on delivering real-time, user-friendly financial insights.

Integrations

QuickBooks has a broader ecosystem of third-party integrations, allowing businesses to connect their accounting data with a wide range of business applications. Zoho Books, on the other hand, benefits from its seamless integration with other Zoho suite applications, providing a more cohesive and streamlined experience for users within the Zoho ecosystem.

Best Practices for Choosing Accounting Software

Consider Your Business Needs and Size

When selecting an accounting software, it is crucial to evaluate your business’s specific needs, size, and growth trajectory. This will help you determine the features, functionality, and scalability required to effectively manage your financial operations.

Evaluate Features and Functionality

Carefully review the features and functionalities offered by both QuickBooks and Zoho Books to ensure they align with your accounting and financial management requirements. Consider aspects such as invoicing, expense tracking, financial reporting, tax preparation, and integration capabilities.

Assess Pricing and Value

Analyze the pricing plans and value proposition of each software solution, taking into account your budget, the number of users, and the long-term cost-effectiveness. Consider any additional features or bundled services that may provide greater value for your business.

Read Reviews and Testimonials

Explore user reviews, case studies, and testimonials to gain insights into the real-world experiences of businesses using QuickBooks and Zoho Books. This can help you understand the software’s strengths, limitations, and the level of customer satisfaction.

Case Studies and Testimonials

Real-World Examples of Successful Use Cases

Small businesses across various industries have successfully implemented QuickBooks and Zoho Books to streamline their accounting processes and gain valuable financial insights. These case studies highlight the software’s ability to improve efficiency, reduce administrative tasks, and support the growth and decision-making of these enterprises.

Customer Feedback and Reviews

Customers of both QuickBooks and Zoho Books have generally provided positive feedback, praising the software’s user-friendliness, comprehensive features, and the level of customer support. However, some users have also reported minor challenges, such as the learning curve or the need for more customization options, depending on their specific business requirements.

Get Started with QuickBooks And Zoho Books

To get started with QuickBooks, you can visit the QuickBooks website and click on the “Sign Up” button to create a new account. The signup process involves providing basic business information, selecting a pricing plan, and setting up your account.

For Zoho Books, you can go to the Zoho Books website and click on the “Sign Up” button. The signup process involves entering your business details, selecting a pricing plan, and configuring your account.

Both QuickBooks and Zoho Books offer free trials, allowing you to explore the software’s features and functionality before committing to a paid subscription.

Frequently Asked Questions

What are the key differences between QuickBooks and Zoho Books?

The key differences between QuickBooks and Zoho Books lie in their features, pricing, and target audience. QuickBooks is a more comprehensive and feature-rich accounting software, while Zoho Books is a cloud-based solution with a focus on ease of use and affordability. QuickBooks generally caters to larger small and medium-sized businesses, while Zoho Books is better suited for smaller businesses and freelancers.

Which software is more user-friendly for non-accountants?

Both QuickBooks and Zoho Books are designed to be user-friendly for non-accountants, with intuitive interfaces and step-by-step workflows. However, Zoho Books may have a slight edge in terms of ease of use, particularly for small business owners and freelancers who are new to accounting software.

How do the pricing plans compare between QuickBooks and Zoho Books?

The pricing plans for QuickBooks and Zoho Books differ significantly. QuickBooks offers a range of plans starting at $25 per month, while Zoho Books has a more tiered pricing structure, with the basic plan starting at $9 per month. The choice between the two will depend on your business size, budget, and specific accounting requirements.

Which software has better integration capabilities?

In terms of integration capabilities, QuickBooks has a broader ecosystem of third-party integrations, allowing businesses to connect their accounting data with a wide range of business applications. Zoho Books, on the other hand, benefits from its seamless integration with other Zoho suite applications, providing a more cohesive experience for users within the Zoho ecosystem.

Which software is better for tax preparation?

QuickBooks is widely recognized for its comprehensive tax preparation features, including the ability to track and categorize tax-related expenses, generate tax reports, and integrate with tax preparation software. Zoho Books also provides tax-related features, but they may not be as advanced as those offered by QuickBooks.

Conclusion

Both QuickBooks and Zoho Books are powerful accounting software solutions that cater to the needs of small and medium-sized businesses. QuickBooks offers a more comprehensive suite of features, advanced reporting capabilities, and a broader ecosystem of integrations, making it a popular choice for larger enterprises. Zoho Books, on the other hand, is a more affordable and user-friendly cloud-based solution, well-suited for smaller businesses and freelancers.

When choosing between QuickBooks and Zoho Books, it is essential to carefully evaluate your business’s specific needs, budget, and growth plans. Consider factors such as invoicing, expense tracking, financial reporting, tax preparation, and integration requirements to determine the software that best aligns with your organization’s accounting and financial management needs.

Ultimately, the decision should be based on a thorough analysis of the features, pricing, and user experience offered by each software solution, as well as the overall value they provide for your business. By selecting the right accounting software, you can streamline your financial processes, gain valuable insights, and position your business for long-term success.