As a self-employed individual, managing your finances and staying on top of your taxes can be a daunting task. Fortunately, there are a variety of accounting software options available to help streamline your financial responsibilities and ensure you stay compliant with tax regulations. Two of the most popular choices are QuickBooks Online and Self-Employed Tax Software.

In this comprehensive article, we’ll explore the key differences and similarities between these two powerful solutions, helping you determine which one is the best fit for your freelance or small business needs.

Table of Contents

The Importance of Accounting Software for Self-Employed Individuals

Being self-employed comes with a unique set of financial challenges. From tracking expenses and invoicing clients to managing quarterly tax payments, the administrative tasks can quickly become overwhelming. That’s where accounting software steps in to save the day.

Investing in the right software can provide self-employed individuals with a centralized hub to manage their finances, automate routine tasks, and ensure they’re prepared when tax season rolls around. By streamlining these critical business operations, you can free up time to focus on revenue-generating activities and grow your freelance or small business.

Understanding QuickBooks Online and Self-Employed Tax Software

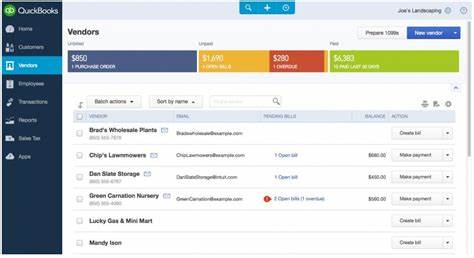

QuickBooks Online is a cloud-based accounting platform developed by Intuit, a leading provider of financial management solutions. It offers a comprehensive suite of features tailored to the needs of small businesses and self-employed professionals.

On the other hand, Self-Employed Tax Software is a specialized tax preparation tool designed specifically for freelancers, independent contractors, and other self-employed individuals. These solutions, often offered by companies like TurboTax and H&R Block, focus primarily on streamlining the tax filing process and maximizing deductions.

Key Differences and Similarities

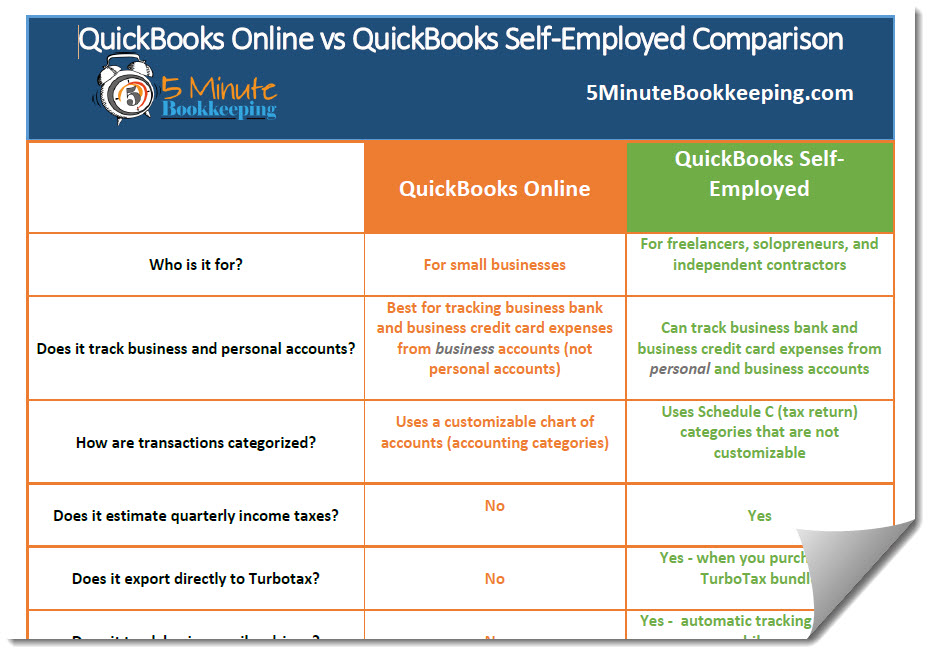

While both QuickBooks Online and Self-Employed Tax Software are valuable tools for self-employed individuals, they have distinct features and functionalities that set them apart. Let’s explore the key differences and similarities:

Invoicing and Expense Tracking

QuickBooks Online excels in its invoicing and expense tracking capabilities. Users can create professional-looking invoices, track payments, and categorize business expenses with ease. The platform also offers features like automated billing, late payment reminders, and the ability to accept online payments.

In contrast, Self-Employed Tax Software typically offers more basic invoicing and expense tracking features, with a greater emphasis on tax preparation and compliance.

Financial Reporting and Analytics

QuickBooks Online provides robust financial reporting and analytics tools, allowing users to generate detailed income statements, balance sheets, and cash flow reports. These insights can help self-employed individuals make informed business decisions and track their financial performance over time.

Self-Employed Tax Software, on the other hand, is more focused on tax preparation and planning, with limited financial reporting capabilities.

Integration with Other Tools

QuickBooks Online seamlessly integrates with a wide range of popular business tools, such as payroll providers, e-commerce platforms, and customer relationship management (CRM) software. This extensibility can help self-employed individuals streamline their workflows and improve overall efficiency.

Self-Employed Tax Software may offer fewer integration options, as their primary focus is on tax preparation and filing.

Tax Preparation and Planning

While QuickBooks Online includes tax-related features, such as the ability to track deductible expenses, Self-Employed Tax Software is specifically designed to handle the unique tax requirements of self-employed individuals. These solutions offer features like Schedule C and Schedule SE filing, personalized tax planning tools, and mileage tracking.

User Experience and Interface

Both QuickBooks Online and Self-Employed Tax Software strive to provide user-friendly interfaces and intuitive experiences, catering to self-employed individuals who may not have formal accounting or tax preparation backgrounds.

QuickBooks Online: A Comprehensive Overview

Core Features and Benefits

QuickBooks Online is a cloud-based accounting platform that offers a comprehensive suite of features for self-employed individuals and small businesses. Some of the core features include:

- Invoicing and Accounts Receivable: Create and send professional-looking invoices, track payments, and manage accounts receivable.

- Expense Tracking: Easily categorize and track business expenses, including the ability to connect bank and credit card accounts.

- Financial Reporting: Generate detailed reports such as profit and loss statements, balance sheets, and cash flow analyses.

- Tax Preparation: Automatically track and categorize tax-deductible expenses, making tax filing more streamlined.

- Mileage Tracking: Record and track business mileage for tax deduction purposes.

- Integrations: Seamlessly connect QuickBooks Online with a variety of popular business tools and services.

Invoicing and Expense Tracking

One of the standout features of QuickBooks Online is its robust invoicing and expense tracking capabilities. Users can create custom invoices, set up recurring billing, and accept online payments. The expense tracking functionality allows for the categorization of business expenses, making it easier to prepare for tax season.

Financial Reporting and Analytics

QuickBooks Online provides comprehensive financial reporting and analytics tools, enabling self-employed individuals to gain deeper insights into their business performance. Users can generate a wide range of reports, including profit and loss statements, balance sheets, and cash flow analyses. These insights can inform important business decisions and help identify areas for improvement.

Integration with Other Tools

QuickBooks Online boasts an extensive ecosystem of integrations, allowing users to connect their accounting platform with a variety of popular business tools. This includes integration with payment processors, e-commerce platforms, payroll providers, and customer relationship management (CRM) software. These integrations can help streamline workflows and improve overall efficiency.

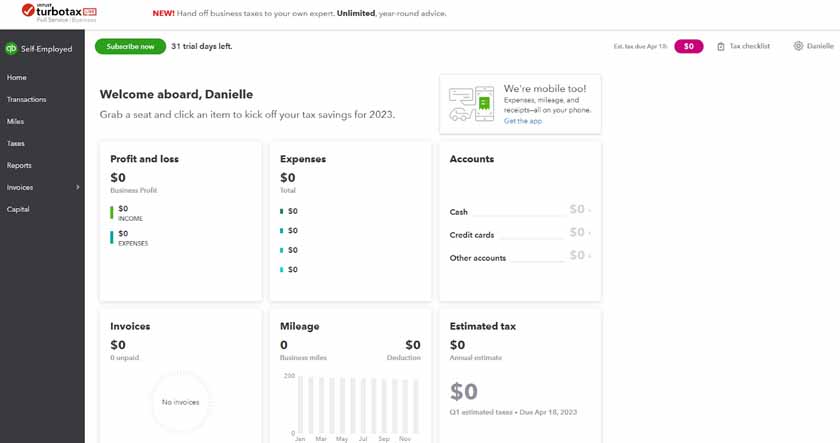

Self-Employed Tax Software: Specialized Features

Schedule C and Schedule SE Filing

Self-Employed Tax Software is designed to simplify the tax filing process for freelancers, independent contractors, and other self-employed individuals. These solutions offer specialized features to handle the unique tax requirements, such as automated preparation of Schedule C (Profit or Loss from Business) and Schedule SE (Self-Employment Tax).

Deductions and Credits for Self-Employed Individuals

Self-Employed Tax Software often includes extensive databases of potential deductions and credits tailored to the needs of self-employed individuals. These tools can help users identify and maximize their eligible deductions, ensuring they’re paying the minimum required taxes.

Mileage Tracking and Expense Reporting

Tracking mileage and business expenses is a critical task for self-employed individuals. Self-Employed Tax Software typically includes features for automated mileage tracking and expense reporting, making it easier to stay organized and claim the appropriate deductions.

Tax Planning Tools

In addition to tax preparation, Self-Employed Tax Software often provides tax planning tools and guidance. These features can help users estimate their quarterly tax payments, understand their overall tax liability, and plan for the upcoming tax year.

User Experience and Interface

Ease of Use for Non-Accountants

Both QuickBooks Online and Self-Employed Tax Software are designed with the needs of self-employed individuals in mind, prioritizing user-friendly interfaces and intuitive navigation. These platforms aim to provide a streamlined experience for users who may not have formal accounting or tax preparation backgrounds.

Mobile Accessibility

In today’s digital landscape, the ability to manage finances on-the-go is essential. QuickBooks Online and Self-Employed Tax Software offer mobile apps, allowing users to access their accounts, track expenses, and perform other tasks from their smartphones or tablets.

Customization Options

While the core functionality of these platforms is often standardized, both QuickBooks Online and Self-Employed Tax Software offer customization options to better suit the unique needs of self-employed individuals. This may include the ability to create custom invoices, configure reporting dashboards, and personalize the overall user experience.

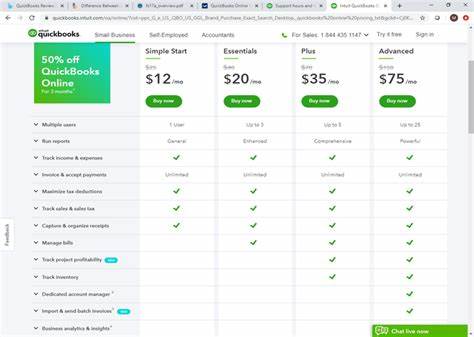

Pricing and Plans

Cost Comparison Between QuickBooks Online and Self-Employed Software

QuickBooks Online offers several pricing tiers, ranging from the basic “Simple Start” plan to more comprehensive “Plus” and “Advanced” plans. Pricing typically starts at around $25 per month for the basic plan and can go up to $150 per month for the advanced version.

Self-Employed Tax Software, on the other hand, is often priced as a one-time fee for the tax filing season, with costs ranging from $59 to $119 or more, depending on the specific features and level of support.

Value for Money Analysis

When comparing the two options, it’s essential to consider the overall value they provide in relation to their respective prices. QuickBooks Online may offer a higher monthly cost but provides a more comprehensive accounting solution with a broader range of features. Self-Employed Tax Software, while more focused on tax preparation, can be a more cost-effective option for self-employed individuals with relatively straightforward financial needs.

Bundles and Additional Features

Both QuickBooks Online and Self-Employed Tax Software may offer bundle packages or additional features at an extra cost. These could include payroll services, access to tax professionals, and other add-ons that can enhance the overall capabilities of the platform.

Customer Support and Resources

Responsive Support Teams

Reliable customer support is crucial when using any accounting or tax preparation software. Both QuickBooks Online and Self-Employed Tax Software typically offer various support channels, such as phone, email, and online chat, to assist users with any questions or issues they may encounter.

Extensive Documentation and Tutorials

In addition to direct support, these platforms often provide comprehensive documentation, FAQs, and educational resources to help users navigate the software and optimize its use for their specific needs.

Community Forums and Resources

Many accounting and tax software providers also maintain active community forums where users can connect, share best practices, and get advice from both fellow users and subject matter experts.

Comparison of Key Features

To help you make an informed decision, let’s compare the key features of QuickBooks Online and Self-Employed Tax Software:

| Feature | QuickBooks Online | Self-Employed Tax Software |

|---|---|---|

| Invoicing and Expense Tracking | Robust invoicing and expense tracking capabilities | Basic invoicing and expense tracking features |

| Tax Preparation | Tracks tax-deductible expenses, but more focused on overall accounting | Specialized for self-employment tax filing and deductions |

| Financial Reporting | Comprehensive financial reporting and analytics tools | Limited financial reporting capabilities |

| Integrations | Extensive ecosystem of integrations with other business tools | Fewer integration options, more focused on tax preparation |

Best Practices for Self-Employed Individuals

Choosing the Right Software for Your Needs

When selecting between QuickBooks Online and Self-Employed Tax Software, consider your specific business needs, the complexity of your financial situation, and your preferred user experience. Evaluate the features, pricing, and overall value each solution provides to ensure you choose the best fit for your freelance or small business.

Organizing Your Financial Records

Regardless of the software you choose, maintaining organized financial records is crucial for self-employed individuals. Consistently categorize expenses, track invoices and payments, and keep meticulous records to ensure a smooth tax filing process and accurate financial reporting.

Staying Compliant with Tax Regulations

Adhering to tax regulations is a top priority for self-employed individuals. Both QuickBooks Online and Self-Employed Tax Software can help you stay compliant by providing features like automated tax calculations, estimated quarterly payment tracking, and guidance on eligible deductions.

Case Studies and Testimonials

Real-World Examples of Successful Use Cases

Many self-employed individuals and small business owners have found success in using QuickBooks Online or Self-Employed Tax Software to manage their finances and tax preparation. These platforms have helped streamline workflows, improve financial visibility, and ensure compliance with tax regulations.

Customer Feedback and Reviews

Online reviews and testimonials from users of both QuickBooks Online and Self-Employed Tax Software are generally positive, highlighting the platforms’ ease of use, robust features, and overall value for self-employed professionals.

Get Started with QuickBooks

To get started with QuickBooks Online, simply visit the QuickBooks website and click on the “Sign Up” button. You’ll be prompted to choose the plan that best fits your business needs, provide some basic information, and set up your account.

The sign-up process is straightforward and typically takes just a few minutes to complete. Once your account is set up, you can begin exploring the platform’s features and integrating it with your business workflows.

Frequently Asked Questions

Q: What are the key differences between QuickBooks Online and Self-Employed Tax Software?

A: The main differences lie in the breadth of features. QuickBooks Online is a comprehensive accounting platform that offers invoicing, expense tracking, financial reporting, and integrations, while Self-Employed Tax Software is more specialized for tax preparation and compliance.

Q: Which software is better for self-employed individuals?

A: The choice between QuickBooks Online and Self-Employed Tax Software depends on your specific business needs. QuickBooks Online may be better suited for self-employed individuals with more complex financial requirements, while Self-Employed Tax Software may be more cost-effective for those with simpler tax needs.

Q: Can I use both QuickBooks Online and Self-Employed Tax Software together?

A: Yes, it is possible to use both platforms in conjunction. QuickBooks Online can provide comprehensive accounting and financial management, while Self-Employed Tax Software can handle the specialized tax preparation and planning aspects of your business.

Q: How much do QuickBooks Online and Self-Employed Tax Software cost?

A: QuickBooks Online pricing starts at around $25 per month for the basic plan and goes up to $150 per month for the advanced version. Self-Employed Tax Software is typically priced as a one-time fee, ranging from $59 to $119 or more, depending on the specific features and level of support.

Q: Do these software platforms offer mobile apps?

A: Yes, both QuickBooks Online and Self-Employed Tax Software offer mobile apps, allowing users to manage their finances and tax-related tasks on-the-go.

Conclusion

When it comes to choosing the right accounting software for your self-employed business, both QuickBooks Online and Self-Employed Tax Software offer compelling solutions. QuickBooks Online provides a comprehensive suite of features, including invoicing, expense tracking, financial reporting, and integration capabilities, making it a robust choice for self-employed individuals with more complex financial needs.

On the other hand, Self-Employed Tax Software is specifically designed to streamline the tax preparation process, offering specialized features like Schedule C and Schedule SE filing, mileage tracking, and tax planning tools. This makes it a more cost-effective option for self-employed individuals with relatively straightforward financial requirements.

Ultimately, the decision between QuickBooks Online and Self-Employed Tax Software will depend on your unique business needs, the complexity of your finances, and your preferred user experience. By carefully evaluating the features, pricing, and overall value of each platform, you can make an informed decision and choose the accounting software that will best support the growth and success of your freelance or small business.