As the self-employment landscape continues to evolve, navigating the complex world of taxes has become a crucial challenge for many individuals. The Best Tax Software 2024 for Self-Employed is a comprehensive guide that explores the unique tax considerations and the most effective solutions available to ensure a smooth and stress-free tax-filing experience.

Table of Contents

The Unique Tax Challenges of Self-Employment

Self-employed individuals face a unique set of tax challenges that often require specialized attention and expertise. From tracking and categorizing business expenses to managing estimated tax payments, the complexities of self-employment taxation can quickly become overwhelming.

Self-employed taxpayers must contend with a myriad of responsibilities, including:

- Accurately reporting business income and expenses on Schedule C

- Calculating and paying self-employment tax on Schedule SE

- Tracking and maximizing eligible deductions and credits

- Estimating and remitting quarterly tax payments to the IRS

- Maintaining detailed financial records and documentation

These tasks can be time-consuming and daunting, especially for those without a background in accounting or tax preparation. Navigating the ever-changing tax landscape and ensuring compliance with evolving regulations can quickly become a full-time job in itself, distracting self-employed individuals from their core business activities.

Why Choose Specialized Tax Software

In response to these challenges, specialized tax software has emerged as a game-changer for self-employed individuals. By leveraging advanced features and capabilities, these solutions can streamline the tax-filing process, maximize deductions and credits, and provide valuable insights to help self-employed taxpayers minimize their tax burden.

Compared to do-it-yourself methods or relying on a traditional accountant, specialized tax software offers several key advantages:

- Comprehensive guidance and step-by-step assistance through the tax-filing process

- Automated tracking and categorization of business income, expenses, and deductions

- Access to a vast database of tax credits and deductions tailored to self-employed individuals

- Seamless integration with financial tools and accounting software for data synchronization

- Personalized tax planning recommendations to optimize year-round tax strategies

- Responsive customer support and a wealth of educational resources

By harnessing the power of specialized tax software, self-employed individuals can save time, reduce stress, and maximize their tax savings, allowing them to focus on growing their businesses.

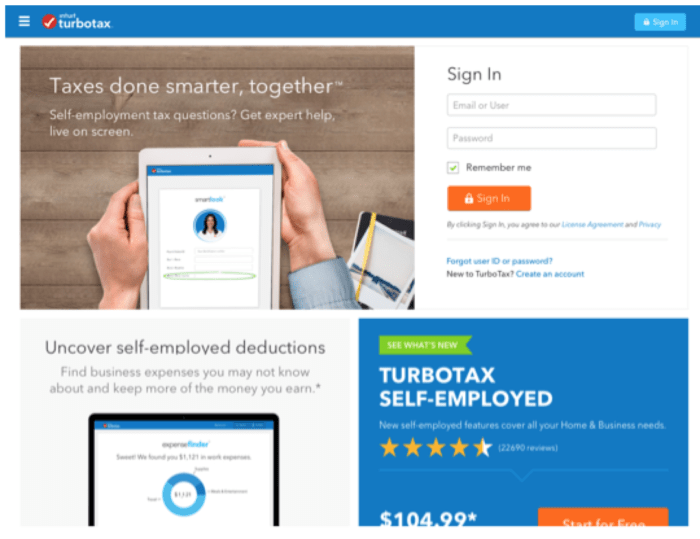

Introducing TurboTax Self-Employed

One of the leading tax software solutions for self-employed individuals is TurboTax Self-Employed. Developed by Intuit, the company behind the popular personal finance software, TurboTax Self-Employed offers a comprehensive suite of tools and features tailored to the unique needs of self-employed taxpayers.

Key Features and Benefits

TurboTax Self-Employed offers a range of powerful features and benefits that cater to the specific requirements of self-employed individuals.

Deductions and Credits for Self-Employed Individuals

The software’s extensive database of deductions and credits enables self-employed taxpayers to identify and claim all eligible tax savings, maximizing their refund or minimizing their tax liability. From home office expenses and vehicle costs to equipment depreciation and healthcare premiums, TurboTax Self-Employed ensures that self-employed individuals can take advantage of every available tax break.

Schedule C and Schedule SE Filing

TurboTax Self-Employed seamlessly guides users through the preparation and filing of Schedule C (Profit or Loss from Business) and Schedule SE (Self-Employment Tax), ensuring accurate and compliant tax reporting. The platform’s intuitive interface simplifies the process of categorizing income and expenses, generating the necessary forms, and calculating the appropriate self-employment tax.

Mileage Tracking and Expense Reporting

The platform’s integrated mileage tracking and expense reporting features help self-employed individuals easily record and categorize their business-related expenses, such as vehicle usage, travel costs, and office supplies. By automating these tasks, TurboTax Self-Employed ensures that users can claim the maximum allowable deductions without the hassle of manual record-keeping.

Income and Expense Categorization

TurboTax Self-Employed provides intuitive tools for categorizing and organizing income and expenses, ensuring accurate and comprehensive record-keeping. The software’s artificial intelligence-powered features can even suggest appropriate categories based on the user’s past transactions, further streamlining the process.

Tax Planning Tools

The software’s tax planning features offer valuable insights and recommendations to help self-employed individuals make informed decisions throughout the year, proactively reducing their tax burden. TurboTax Self-Employed provides personalized tax projections, estimated payment calculations, and guidance on adjusting withholdings or making additional contributions to retirement accounts or health savings plans.

Ease of Use and Interface

TurboTax Self-Employed is designed with the non-accountant self-employed individual in mind, offering an intuitive and user-friendly interface that guides users through the tax-filing process step by step.

Intuitive Design for Non-Accountants

The platform’s clean and straightforward design ensures that even those with limited tax expertise can easily navigate the software and complete their tax returns with confidence. TurboTax Self-Employed breaks down complex tax concepts into simple, understandable terms, making the process accessible to a wide range of users.

Step-by-Step Guidance

TurboTax Self-Employed provides clear and concise instructions, tailored to the user’s specific situation, ensuring a seamless and stress-free tax-filing experience. The software’s interactive interview-style format prompts users with relevant questions, automatically populating the necessary forms and calculations based on their responses.

Integration with Other Financial Tools

The software’s ability to integrate with popular personal finance and accounting tools, such as Mint and QuickBooks, further streamlines the tax-filing process by automatically importing relevant financial data. This integration ensures that self-employed individuals can leverage their existing financial records, reducing the time and effort required to gather and input information.

Pricing and Plans

TurboTax Self-Employed offers a range of pricing options and plans to accommodate the diverse needs and budgets of self-employed individuals.

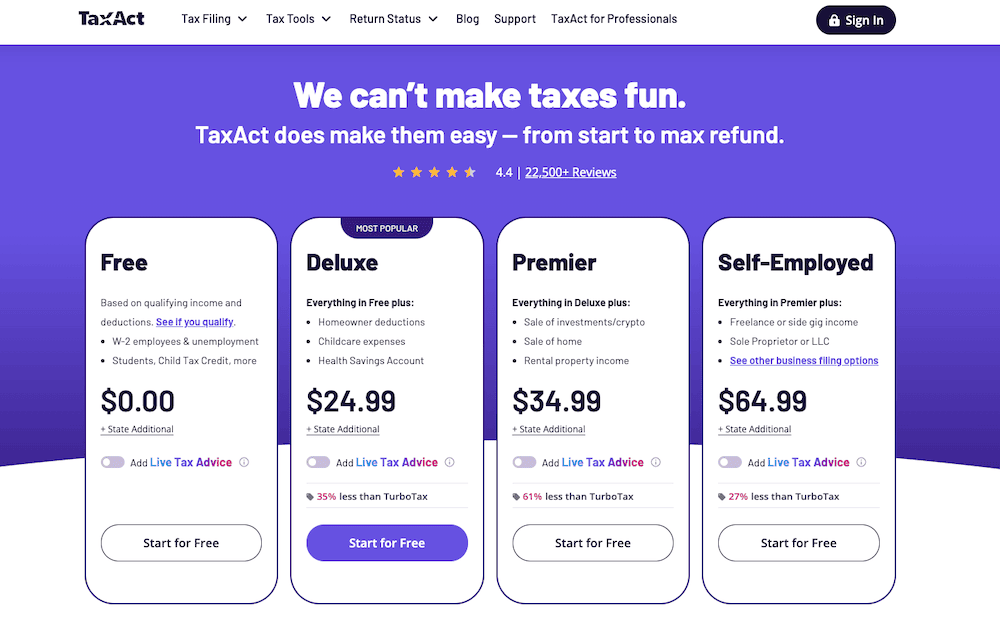

Cost Comparison with Competitors

When compared to other leading tax software solutions, TurboTax Self-Employed is competitively priced, offering excellent value for the comprehensive features and capabilities it provides. While the software may have a slightly higher upfront cost than some basic tax preparation programs, its extensive self-employment-focused tools and features often outweigh the difference in price.

Value for Money Analysis

The platform’s combination of advanced features, user-friendly interface, and responsive customer support make it a highly cost-effective solution for self-employed taxpayers. By maximizing deductions, minimizing tax liabilities, and streamlining the entire tax-filing process, TurboTax Self-Employed can help self-employed individuals save significantly more than the cost of the software.

Bundles and Additional Features

TurboTax Self-Employed also offers various bundled packages that include additional features, such as audit support and financial planning tools, providing even greater value for self-employed individuals. These bundles can be particularly beneficial for self-employed taxpayers who require comprehensive tax and financial management solutions.

Customer Support and Resources

TurboTax Self-Employed is backed by a dedicated team of customer support professionals and a wealth of educational resources to ensure a seamless and supportive tax-filing experience.

Responsive Support Team

The platform’s customer support team is available to assist self-employed individuals with any questions or issues they may encounter during the tax-filing process. Whether it’s navigating the software, understanding tax-related concepts, or seeking guidance on specific situations, the support team is dedicated to providing timely and knowledgeable assistance.

Extensive Help and Documentation

TurboTax Self-Employed offers a comprehensive library of guides, tutorials, and FAQs to help self-employed taxpayers navigate the software and understand the complexities of self-employment taxation. This extensive documentation covers a wide range of topics, from maximizing deductions to managing estimated tax payments, ensuring that users can find the information they need to confidently complete their tax returns.

Community Forums and Resources

The platform also provides access to a vibrant community of self-employed individuals, where users can share insights, ask questions, and find additional support and resources. These online forums and discussion boards allow self-employed taxpayers to learn from the experiences of their peers, and tap into a collective wealth of knowledge and expertise.

Case Studies and Testimonials

TurboTax Self-Employed has a proven track record of helping self-employed individuals successfully navigate the tax-filing process, as evidenced by numerous case studies and customer testimonials.

Real-World Examples of Successful Tax Filing

These case studies showcase how TurboTax Self-Employed has helped self-employed taxpayers maximize their deductions, minimize their tax liability, and achieve favorable outcomes. From freelance writers and independent contractors to small business owners and gig workers, the software has demonstrated its effectiveness in addressing the unique tax challenges faced by self-employed individuals.

Customer Feedback and Reviews

Overwhelmingly positive customer reviews highlight the platform’s user-friendly interface, comprehensive features, and the peace of mind it provides to self-employed individuals during tax season. Users consistently praise the software’s ability to simplify the tax-filing process, identify valuable deductions, and provide personalized guidance, making it an indispensable tool for self-employed taxpayers.

Comparison to Competitors

While there are several tax software solutions available in the market, TurboTax Self-Employed stands out with its robust feature set, user-friendly design, and exceptional value proposition.

Compared to other leading tax software options, TurboTax Self-Employed offers a more comprehensive suite of features and tools specifically tailored to the needs of self-employed individuals. Features like advanced mileage tracking, seamless integration with accounting platforms, and personalized tax planning recommendations set it apart from more generalized tax preparation programs.

Additionally, TurboTax Self-Employed is often praised for its intuitive interface and step-by-step guidance, making it an ideal choice for self-employed taxpayers who may not have extensive tax expertise. This user-friendly approach, combined with the software’s extensive database of self-employment-related deductions and credits, helps ensure that self-employed individuals can maximize their tax savings without the burden of complex tax calculations and form preparation.

Additional Features and Benefits

In addition to its core tax-filing capabilities, TurboTax Self-Employed offers a range of supplementary features and benefits that further enhance the self-employed taxpayer’s experience.

Tax Audit Support

The platform’s audit support services provide self-employed individuals with guidance and resources in the event of a tax audit. TurboTax Self-Employed offers assistance in gathering and organizing documentation, understanding audit correspondence, and navigating the audit process, helping to ensure a successful outcome.

Financial Planning Tools

TurboTax Self-Employed integrates with financial planning tools, offering self-employed individuals valuable insights and recommendations to manage their finances more effectively. These features include retirement planning calculators, investment tracking, and personalized guidance on budgeting and cash flow management.

Integration with Accounting Software

The software’s seamless integration with popular accounting platforms, such as QuickBooks and Xero, allows self-employed individuals to effortlessly sync their financial data and streamline their tax-filing process. This integration eliminates the need for manual data entry, reducing the risk of errors and ensuring that all relevant information is accurately captured.

How to Get Started with TurboTax Self-Employed

As a self-employed individual, navigating the tax-filing process can be a daunting task. TurboTax Self-Employed simplifies this process by providing a comprehensive and user-friendly platform to guide you through every step. Here’s a step-by-step guide on how to get started with TurboTax Self-Employed:

1. Choose Your TurboTax Self-Employed Plan

The first step is to select the TurboTax Self-Employed plan that best suits your needs. TurboTax Self-Employed offers several plan options, including:

- TurboTax Self-Employed: The base plan, which provides all the essential tools and features for self-employed individuals.

- TurboTax Self-Employed Live: An enhanced plan that includes live, on-demand support from a tax expert.

- TurboTax Self-Employed Premier: A premium plan that offers additional features, such as tax audit support and financial planning tools.

Review the features and pricing of each plan to determine which one aligns with your specific requirements and budget.

2. Create Your TurboTax Account

Once you’ve selected your desired TurboTax Self-Employed plan, you’ll need to create an account. This process typically involves providing your personal information, such as your name, email address, and a secure password.

3. Start Your Tax Return

After creating your account, you can begin your tax return by answering a series of questions about your self-employment status, income sources, and expenses. TurboTax Self-Employed will guide you through this process, ensuring that you don’t miss any important details.

4. Import Financial Data (Optional)

To streamline the tax-filing process, TurboTax Self-Employed offers the ability to integrate with various financial tools and accounting software, such as Mint, QuickBooks, and Xero. This integration allows the software to automatically import your relevant financial data, reducing the time and effort required to manually input this information.

5. Claim Deductions and Credits

One of the key benefits of using TurboTax Self-Employed is its extensive database of deductions and credits tailored specifically for self-employed individuals. The software will prompt you with relevant questions and guide you through the process of claiming all eligible deductions and credits, ensuring that you maximize your tax savings.

6. Review and File Your Tax Return

After completing the necessary steps, TurboTax Self-Employed will provide a comprehensive review of your tax return, highlighting any potential errors or omissions. Once you’re satisfied with the information, you can electronically file your return directly with the IRS, or print and mail the necessary forms.

7. Explore Additional Features and Resources

TurboTax Self-Employed offers a wealth of additional features and resources to support self-employed individuals throughout the year, such as:

- Tax planning tools

- Audit support

- Financial management and budgeting features

- Educational guides and community forums

Explore these features to ensure you’re taking full advantage of TurboTax Self-Employed and staying informed about the latest tax laws and strategies.

Conclusion

The Best Tax Software 2024 for Self-Employed has firmly established TurboTax Self-Employed as the ultimate solution for self-employed individuals navigating the complexities of tax filing. With its comprehensive features, user-friendly interface, and exceptional customer support, TurboTax Self-Employed empowers self-employed taxpayers to maximize their deductions, minimize their tax burden, and focus on growing their businesses.

Whether you’re a freelancer, independent contractor, or small business owner, TurboTax Self-Employed is the ideal choice to simplify your tax-filing process and ensure a stress-free, successful tax season. Experience the power of TurboTax Self-Employed and take control of your tax obligations today.